How to keep your parties and gifts un-taxable this festive season.

Celebrating the holidays with your employees is important for team moral, and as we approach the festive season, many employers will be thinking about treating their teams to Christmas parties and gifts.

Whilst it’s a good sentiment, be careful – if either your gifts or parties go over certain limits, they can become taxable either to your business or your employees. With that unwelcome surprise, the seasonal feeling of goodwill will soon be lost.

So, what rules should you be aware of? Read our helpful guide on un-taxable seasonal gifts and celebrations:

The seasonal goodwill of a Christmas party or gift to an employee may soon be lost if this creates a tax liability for them. It is important employers take this into consideration as planning for the festive season begins.

Company parties

Parties for Christmas and summer etc. fall under the Annual Social Functions exemption and can be provided free of income tax and National Insurance Contributions (NICs), providing that all the following conditions are met:

- The total VAT-inclusive cost of providing the event does not exceed £150 per head (this is applied across all annual events during the year).

- The event is held annually.

- All employees are invited to the event.

The £150 limit was introduced in 2003, and, as it has not been adjusted for inflation since, it might be easier than expected to exceed the limit this year, especially if more than one Annual Social Function is held. Care must be taken when the £150 per head is calculated – it must include all VAT inclusive costs for the event, including any transport or hotels the employer may provide.

If the £150 limit is exceeded across the tax year, the event that causes the limit to be exceeded becomes taxable in full, rather than just the excess over £150. Where more than one annual event has occurred in the tax year employers can determine which event this is. Where an event is taxable the benefit is reportable on the respective employees’ form P11D, with income tax paid by the employee at their marginal rate and Class 1A NIC due from the employer. The alternative is for the employer to agree a PAYE Settlement Agreement (PSA) with HMRC to pay the income tax and NIC on behalf of employees on a grossed-up basis. While this route will ensure no goodwill is lost with employees it does represent a further cost to the employer with the tax and NIC liability payable by October following the end of the relevant tax year.

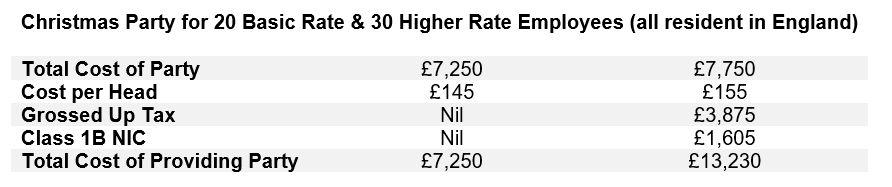

Illustration 1 highlights the significant difference in cost for an employer between providing a Christmas Party that falls within the exemption and one that is slightly over the £150 and is then included on a PSA:

Illustration 1:

Employee gifts

Where a gift is given to employees by an employer, it may fall under the Trivial Benefit Exemption and can be provided free of income tax and NIC – provided that it meets the following criteria:

- The total VAT inclusive cost of the gift does not exceed £50 (per head if provided to a group);

- The benefit is not cash or a cash-voucher (a store gift voucher is acceptable);

- The employee is not entitled to the benefit as any part of a contractual obligation or pursuant to a relevant salary sacrifice arrangement; and

- The benefit is not provided in recognition of services performed by the employee as part of their employment duties.

The Trivial Benefit Exemption above is available all year round but is perhaps most appropriate during the festive season, when gifts are provided for no reason other than the festive occasion. All that being said, it is also worth noting that special rules apply to Directors of close companies and their associates and the quantum of Trivial Benefits they can receive.

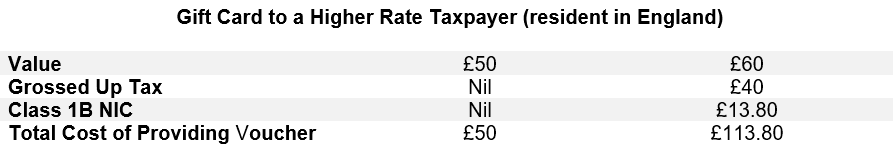

Illustration 2 shows the difference between providing a voucher to an employee that falls within the exemption and one that requires reporting on a PSA:

Illustration 2:

Need further advice on making sure that your company gifting remains tax-free? Whether you’re planning an upcoming event or assessing a party you’ve already thrown, get in touch with a member of our Employment Tax team for further help. Contact us on 01223 728222 or email us at pem@pem.co.uk.

This article was correct at time of publication.