Many companies are forced to incur expenditure on the decontamination of UK land prior to undertaking construction activities. There is a generous tax relief specifically designed to benefit those paying for decontamination so it is worthwhile seeking advice to determine whether this relief would be available to you.

Who can claim the relief?

The relief is only available to limited companies who are undertaking a trade or a property investment activity. This can include corporate partners.

How much is the relief?

Relief is given in the form of a 150% deduction of the costs from trading or property business profits and, if the company is loss making, can even generate a cash refund from HMRC.

Where a company has a ‘qualifying land remediation loss’ it is entitled to claim a tax credit. The qualifying loss is the lower of the remediation relief claimed (the 150% claim) and the ‘unrelieved’ trading or property business loss. The tax credit payable is 16% of the qualifying land remediation loss for the period. There is an example of potential savings at the end of this fact sheet.

When is relief given?

Where the costs sit in stock the relief is given in the year in which the stock is sold. Where the costs sit in capital the company may make an election for any qualifying capital expenditure to be deducted as a revenue expense as opposed to capital and so will become deductible in computing trade profits.

What is contamination?

Contamination is defined as something which can cause “relevant harm”, being death, injury or damage to living organisms, pollution of controlled waters, adverse effect on the ecosystem or structural or significant damage to buildings and structures.

Contamination must be as a result of industrial activities (mining and quarrying, manufacturing, supply of electricity, gas and water or the construction industry). This will include asbestos in buildings as these arose as the result of construction activities, even if their current use is not industrial. In the case of Japanese knotweed, radon and arsenic there does not have to have been industrial pollution.

What are the conditions for the relief?

The owner must have acquired the land in a contaminated state (i.e. the polluter cannot benefit) and have acquired it for the purposes of its trade.

The expenditure must be incurred for the purpose of:

- Preventing, minimising, or remedying the harmful effects arising from the land being in a contaminated state; or

- Restoring the land to its former state.

The expenditure must satisfy certain conditions for the additional relief to be obtained:

- It must be on land, all or part of which is in a contaminated state.

- It must be on relevant land remediation directly undertaken by the company or on its behalf.

- It must be on employee costs, materials or qualifying expenditure on sub-contracted land remediation.

- It would not have been incurred had the land not been in a contaminated state.

- It cannot be subsidised.

- It cannot include landfill tax.

Derelict Land

The relief also extends to derelict land, which is defined as land not in a productive state and which cannot be put into a productive state without the removal of buildings or other structures. It must have been derelict from the date of acquisition, if earlier. There are detailed rules as to what expenditure can qualify.

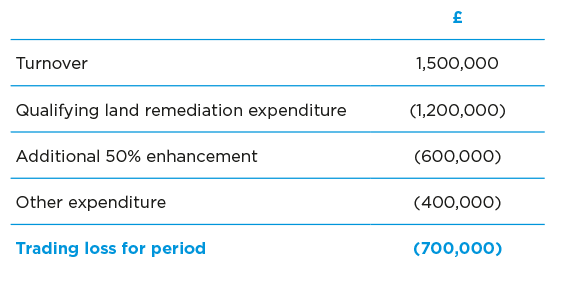

Example

Tax credit available = 16% of lower of:

Land remediation relief – £1,800,000;

and Unrelieved loss – £700,000

Tax credit payable of 16% x £700,000 = £112,000

Alternatively, the company could choose to not claim the tax credit and carry the loss forward against future trading or property business profits.