Published in September 2024, the ICAEW set out some guidance on ex-gratia payments. Sections 15 and 16 of the Charities Act 2022 which may be helpful for charity’s preparing procedures to reflect the new permissions within the Act.

However, there is no date on the website of the Department for Culture, Media and Sport for their implementation as yet for implementation (last update was later in 2024).

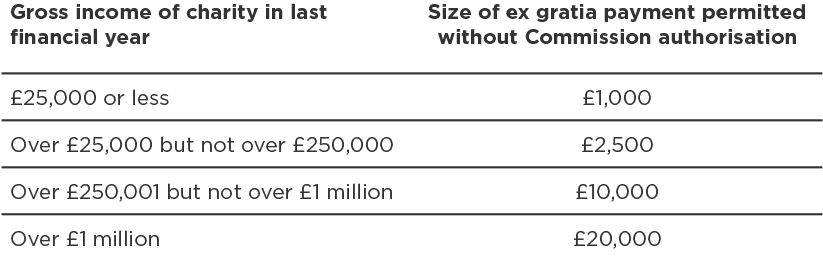

The Act will expand the power of trustees to make ex gratia payments without seeking permission from the Charity Commission, provided the payment does not exceed the specified threshold and a moral obligation exists.

If the charity’s governing document expressly restricted the new statutory power, approval from the Commission will still be required. It should be remembered that any ex gratia payment made (even within the limits) should be disclosed along with the reason or legal authority (with the exception of small gifts, for example chocolate and flowers). The proposed limits are:

Some payments for example non-contractual agreements around redundancy or other arrangements may, whilst non-contractual, not be ex gratia, as the charity is clearly making the payment in its best interest to resolve an issue. If a charity is in doubt over whether a payment can be made it should take legal advice. If the charity has made non-contractual redundancy or other payments these will also require disclosure in accordance with the requirements of the SORP.

Read the latest Charities and Non-profit newsletter to find out more about further changes that will impact the sector.

If you would like to discuss how this guidance might affect you, please get in touch with our team.

This article was correct at the time of publishing.